I was recently working with a client that had run his business for almost 20 years. He was doing about £250k revenue per year and employed a handful of people, mostly part-time.

Now in his 50s, he was rethinking what he wanted from life, wondering what retirement would bring, and even if it would ever come. With ambitions of holiday homes and a comfortable lifestyle free from the pressures of running a business, he turned his gaze to selling the company.

To give you further insight, this company has a diverse product line and primarily attracted people online to transact through its website. Out of 100 visitors, it would convert between 1% to 3% into a customer each month. That was a good month. There were some months when people did not convert. They had done exceptionally well during the COVID-19 pandemic, but their income was inconsistent and created anxiety.

I was recently reminded when working with another client (doing over £100 million in revenue), that paradoxically, the best companies that sell are those that would be great to keep. Build them with an exciting vision, enticing proposition, and stable revenue, with potential for even greater growth, and who wouldn’t want to be a part of that?

So, what did this business owner do?

Very often, business owners bounce between their next great idea and the day-to-day running of the business. Usually, one consumes more time than the other, depending on what’s going on for that individual.

At the time of my engagement, this business owner was looking at building an app. Having seen news headlines of companies selling for millions because of their technology, he thought this was a sure-fire way to enable the company’s scalability and secure a higher value at sale.

However, this is a prime example of when technology is not the answer!

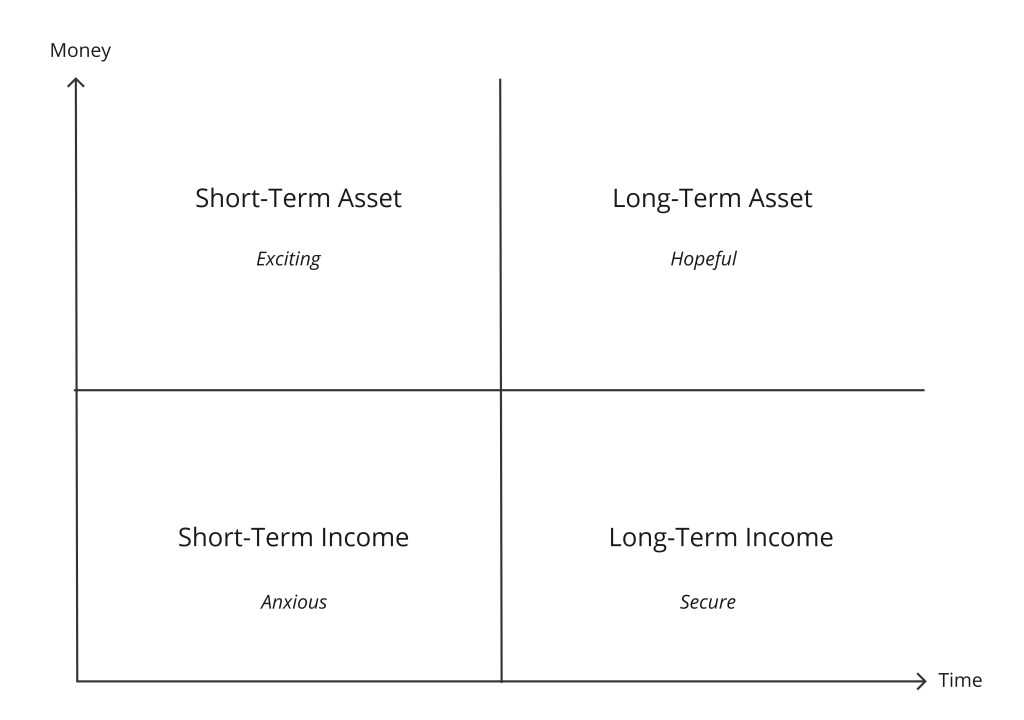

When developing their companies, business owners must make decisions between building assets or focussing on their income. The graph below depicts what this looks like:

The business owner in this example was focused on asset over income, when they needed to focus solely on income. They were already living in the short-term income quadrant with inconsistent sales. This resulted in an anxious state often described as ‘feast or famine’. By building a new product, this meant creating an asset but as a short-term solution. A short-term solution that would have required additional time & money the business did not have.

It is interesting to notice the thinking around building an asset. Previously, the business owner had developed more product lines to increase income. This is again on the asset level and short-term. The business owner would default to building more assets rather than leveraging what they had already created into income. I am always reminded that human beings are creatures of habit. At times of stress, we default to our natural inclinations.

So, how did I help this client? I helped the business focus on building long-term income through campaigns and partnerships.

However, the lesson in this story is to identify where a business is putting its focus and energy. If you’re a business owner reading this, it might be worth looking at how each quadrant in the diagram feels. If you are experiencing a feeling about your business now, where does it fall? Are you anxious about when the next influx of money will occur? Are you excited about launching something new? Are you hopeful for the future, that what you are building will be worth more then, than it is now? Or are you feeling pretty secure?

If you’d like to discuss how to determine whether you should focus on income or asset then get in touch by emailing chris.robertson@sgfe.co.uk.